Conservation Easements

Landowners may protect their property from certain activities (like development) by installing a restriction on their deed. This process is known as a conservation easement and permanently prohibits those activities on that property. Other property rights not defined under the easement remain as before the easement.

The creation of an easement generally reduces the property value, thereby reducing the value of your estate and possibly the property tax as well. The easement is sold (or donated to a charitable organization) allowing you to take a deduction on federal and state income taxes.

The property should be appraised by a qualified conservation easement appraiser to establish the value before the easement is created. The appraiser would then be able to valuate the property once the easement restrictions are put into place, establishing the value of the easement or donation. Generally, conservation easements reduce the property values by 15%-45% based on the property attributes along with what rights of ownership are “given up.”

The landowner may take a deduction of up to 50% of their federal adjusted gross income for the year. The deduction may be carried forward for 15 additional years, should the full value not be deducted in the first year, or sold usually at a discount through a conservation easement broker.

Virginia landowners may take a tax credit up to 40% of the easement fair market value to not exceed $20,000 per year, but cannot exceed the tax liability for that year. The unused credit may be carried forward for a period up to 13 years, or sold usually at a discount through a conservation easement broker.

The easement will lower the estate taxes that a landowner’s heirs would have to pay, also. It will reduce the aggregate value of the property for estate tax purposes and provides for an estate tax exclusion.

Numerous organizations and state and federal agencies are available to provide information regarding conservation easements. General information may be obtained by calling the Land Trust Alliance at (202) 638-4725, or the Virginia Department of Forestry at (434) 977-6555.

EnviroFor, LLC. strongly recommends that you speak with qualified real estate, tax, and legal advisors before undertaking the establishment of conservation easements as property values, tax considerations, and legal issues are subject to change. This document is for informational purposes only and in no way constitutes advice on matters regarding conservation easements.

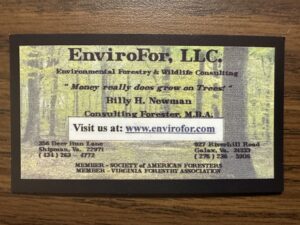

Money REALLY does grow on trees!

"What is YOUR timber worth?"

Contact EnviroFor, LLC.

EnviroFor, LLC.

356 Deer Run Lane

Shipman, Virginia 22971

(434) 263-4772

[email protected]